If your companies has a large fleet of lorries, gradually, it might be extra costly to insure the fleet for physical damages than it is to retain the danger, that is, pay for any kind of physical damage straight instead than by insurance policy (additionally referred to as self-insurance). Regardless of the amount of vehicles your business has, it might be cost effective to carry physical damages coverage just on the more recent or better vehicles - vans.

cheapest insurance companies laws low cost

cheapest insurance companies laws low cost

One of the most that will certainly be paid is the minimal of the ACV or the price to repair or change the automobile with one of like kind and also quality. In case of a total loss, the ACV is changed for depreciation and the car's physical condition. Hence, the older the vehicle and the worse its problem, the more its worth has actually depreciated as well as the less the insurance firm will pay - cheap car insurance.

In situation of a theft, it may return the swiped car to you with repayment for any kind of damages brought on by the theft. Responsibility Insurance coverage The obligation portion of the BACF binds the insurer to pay all problems business is legally bound to pay as a result of bodily injury or residential property damages created by a covered automobile, up to the plan limitations - insurance.

The choice whether to contest or work out the instance is entirely at the insurer's discretion. The insurance provider's duty to safeguard or resolve ends when the insurance coverage restrictions are tired. Using instance, imagine that three individuals are hurt in a mishap in which you or among your staff members is at fault.

That leaves your company liable to pay the honor straight, ought to there be a judgment in favor of the third individual - auto insurance. Corrective problems might be granted in instances of gross negligence, such as drunk or careless driving. By law in a number of states, a BACF can not cover any corrective damages for which you may be liable (auto insurance).

The Best Strategy To Use For What Is The Cost Of Commercial Auto Insurance For Small ...

When Your Organization Car Is Additionally Your Personal Automobile Occasionally staff members or executives of a firm or various other individuals who are provided with an automobile had by the firm have only that vehicle (cheap insurance). They do not own an individual automobile neither do they obtain individual car insurance coverage. The BACF does not cover individual use of the automobile in this situation.

cheaper auto insurance car insurance vehicle insurance car insured

cheaper auto insurance car insurance vehicle insurance car insured

To secure your business from these obligation dangers you can add this kind of obligation to the BACF either under "any type of vehicle' or "non-owned automobiles.", which provides protection when employees drive their own automobiles on company - liability. The kinds of vehicles that are covered are suggested by several numeric signs that show up in the affirmations.

A situation of negligent entrustment emerges when someone enables an additional person to make use of an automobile knowing or having reason to understand that making use of the automobile by that individual produces a danger of damage to others. Any type of damages granted for irresponsible entrustment would be on top of obligation for the accident itself.

How Organization Vehicle Insurance Can Aid Safeguard You Whether you rely upon a single auto or a big fleet of cars, business auto insurance coverage is something most organizations need. That's due to the fact that a mishap can take place to even one of the most careful driverand these mishaps can set you back thousands or even countless bucks.

Generally, insurance firms recommend services have a minimum of $500,000 for responsibility insurance coverage, yet $1,000,000 is far better as well as it won't add a substantial total up to the costs. You may require even greater responsibility limitations than the advised quantities depending upon factors such as the size of your automobile as well as the sort of materials you transport.

The Best Guide To Get Your Free Commercial Auto Insurance Quote

A lorry bring harmful substances, on the various other hand, requires $5,000,000 responsibility protection. You can see Missouri's electric motor provider demands in the Missouri Trucking Guide. Kinds Of Commercial Automobile Insurance Coverage Your commercial automobile insurance plan may consist of the complying with coverage depending on your needs and state needs: Bodily injury obligation: Covers you and your workers if you or a worker triggers injury to one more event while utilizing the business vehicle Property damage responsibility: Covers you as well as your employees if you or a worker creates damage to an additional party's home while utilizing the covered automobile Clinical repayment protection: Pays the clinical costs of the vehicle drivers as well as passengers of the business vehicle in a crash, despite that's at fault Accident: Spends for vehicle repairs after a mishap no matter of mistake Comprehensive: Pays for damage to the lorry as a result of theft, weather condition occasions or various other non-collision accidents Without insurance or underinsured vehicle driver protection: Shields you if a without insurance or underinsured driver damages your business car Trailer interchange insurance coverage: Safeguards the trailer you utilize that is possessed by an additional business Rental repayment with downtime insurance coverage: Covers the cost of leasing another commercial automobile if your company's vehicle requires repairs Employed car protection: Offers insurance coverage if you rent commercial automobiles for staff members or clients Non-owned car coverage: Covers you if staff members utilize their very own automobile while benefiting you Non-trucking responsibility: Safeguards if you utilize your industrial car for personal reasons Cargo insurance: Covers freight that is shed or damaged as a result of a crash or other occasion Bobtail insurance coverage: Secures you and your semi-trailer vehicle when you are not hauling a trailer Physical damage protection: A general term that consists of collision as well as detailed protection What Does not an Industrial Vehicle Plan Cover? Numerous options are available to help you create a tailored commercial automobile policy, some points can not be covered by your business's vehicle insurance policy.

Various other variables such as the state of the reinsurance market, the frequency of unskilled chauffeurs, higher clinical costs, distracted driving and also reduced gas prices influence industrial vehicle insurance policy premiums - vehicle insurance. Exactly how Do I Lower My Commercial Insurance Premiums? Despite the fact that business vehicle insurance comes with a greater price than individual car insurance policy, there are still methods to decrease your costs as well as boost your company's bottom line (credit score).

Final Judgment While all the service providers we chose have great protection, Progressive Commercial stuck out to us because it is the largest industrial auto insurance provider as well as provides bonus at no added expense. The most effective industrial car insurance policy for your company will depend upon numerous aspects, consisting of the dimension of your fleet, which vehicles your workers use, and how typically they drive (vehicle insurance).

Exactly How Is Commercial Cars And Truck Insurance Policy Different From Personal Automobile Insurance Coverage? Business vehicle insurance is comparable to personal automobile insurance coverage in that it monetarily shields you or your staff member in case of an accident. prices. However, although industrial automobile insurance policy covers your lorry for personal use, individual car insurance does cover your automobile for organization use.

Exactly how We Selected the very best Commercial Automobile Insurance coverage We assessed nearly two lots business car insurance policy suppliers based on financial toughness, client service and declares complete satisfaction, protection used, and also price cuts supplied. We also took notice of any kind of one-of-a-kind features given and also provided preference to business that had some rates information online or offered online quotes (car).

Not known Facts About How To Pick The Best Commercial Auto Insurance - Agency ...

Repairing damage to a lorry can be costly for more than one reason. Commercial auto insurance policy covers the price to repair or replace the automobile (less depreciation), in addition to the expense to rent a replacement automobile so your service can proceed operating. Industrial automobile insurance can provide clinical expense insurance coverage as well as uninsured drivers coverage to people guaranteed on the policy.

We compared variables such as schedule, customer fulfillment rankings, prices, monetary strength rankings, as well as protection options. We also considered the convenience with which entrepreneur can buy a plan, make adjustments to their coverage, and also file a case if needed.

Factors That Can Influence Your Commercial Car Rate Similar to the premium you spend for your individual vehicle policy, there are lots of factors that might impact the expense of your commercial car insurance coverage policy as well. Generally, the following aspects have a tendency to affect your business automobile insurance policy price, though they may vary by insurance provider, state, and also organization. affordable car insurance.

That very same flower delivery vehicle may set you back less to insure if it delivers flowers in rural Tennessee than if it provides flowers in the heart of Dallas, Texas (perks). There are a variety of commercial automobile insurance coverage protections for you to pick, from one of the most standard coverages like Bodily as well as Residential Property Damage Responsibility, to optional coverages like Permissive Use as well as Medical Repayments.

Automobiles that move people have a tendency to be slightly more expensive, and sturdy cargo cars managing tons in unwanted of 10,000 lbs have a tendency to be the most costly to insure. As your service's liability threat goes up, so might the price of insurance coverage. This may be one of one of the most important aspects when it pertains to estimating the price of business car insurance coverage, as well as for a couple of factors (car insurance).

The Main Principles Of Commercial Auto Insurance: Coverage & Quotes - Advisorsmith

Second, employees with poor Visit this link driving documents might cost you more to insure, or may prevent you from getting the insurance policy you require entirely - cheap car. Reducing Your Commercial Automobile Insurance Coverage Prices While the price of industrial vehicle insurance coverage differs considerably relying on your business as well as the insurer you choose, there are generally a handful of means you could potentially lower your industrial automobile insurance costs (money).

affordable auto insurance cheap auto insurance vehicle insurance cheap

affordable auto insurance cheap auto insurance vehicle insurance cheap

What is commercial vehicle insurance? Industrial car insurance coverage, additionally described as business vehicle insurance, is a car insurance coverage created for vehicles that are used by as well as for business functions. These insurance coverage can shield your workers and other vehicle drivers if there's an accident or perhaps if a car is harmed while it's not in usage. automobile.

cheapest car insurance auto insurance dui

cheapest car insurance auto insurance dui

Commercial vehicle insurance coverage can cover a series of lorries utilized for service such as delivery van, job vans, building and construction vehicles, food vehicles, and standard company automobiles. How is service automobile insurance various from personal automobile insurance? Numerous service proprietors think that their personal automobile insurance plan will cover them if they remain in a wreckage, yet that's not always the situation (car).

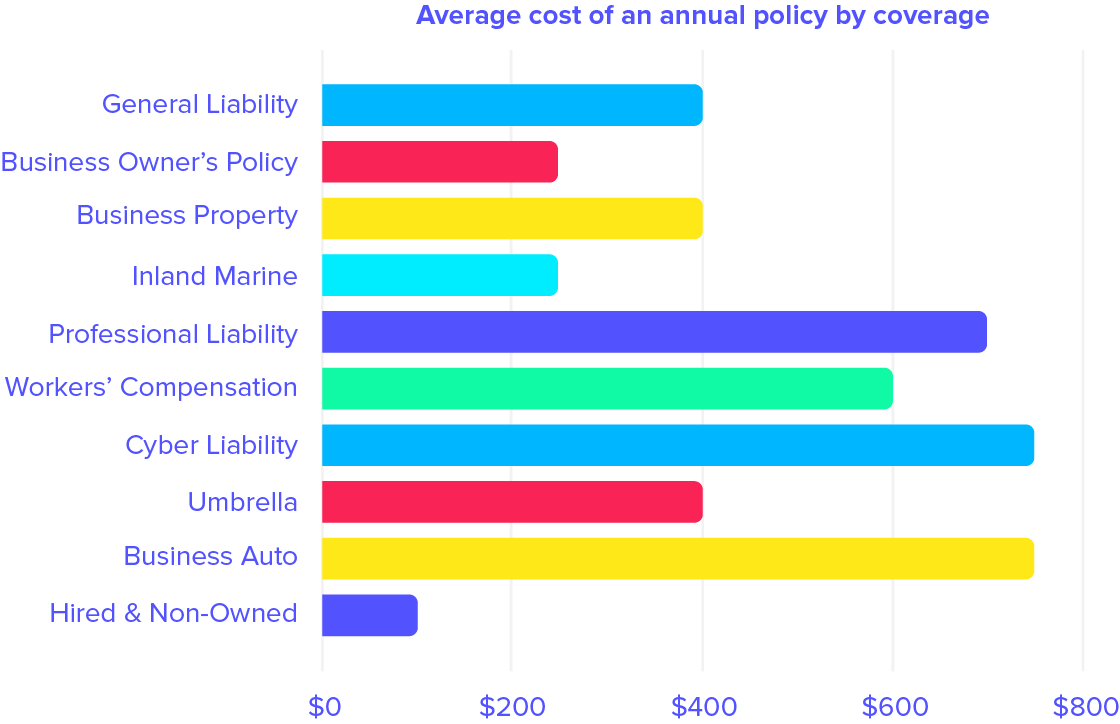

Cargo vans and distribution vehicles are more pricey, generally costing about $3,300-$6,200 annually. Commercial automobile insurance coverage expenses vary based on the quantity of coverage you have, the variety of automobiles covered by the policy, and also the kind of vehicles on the plan. Costs can additionally depend upon exactly how risky your market is (such as construction or demolition), the driving history of the vehicle driver, and various other rewards included in the plan.

It will likely still be covered under the commercial vehicle policy, yet you'll require to include the correct info in the declarations section of your policy. If your job automobile is set up on your company vehicle policy and you effectively declare that workers might make use of the lorry for individual use, your automobile is covered by the organization vehicle plan.

Commercial Auto - Minnesota.gov Can Be Fun For Everyone

What is industrial automobile insurance? Commercial vehicle insurance is a kind of insurance coverage policy that covers cars used for organization purposes. Any kind of automobile that is used for business-related purposes should be covered by business insurance, whether it's a van, pickup, box vehicle, energy vehicle, food truck or a regular car.

For one, commercial auto insurance policy can just be made use of for organization vehicles. Typically this implies automobiles that are possessed by organizations, yet it can indicate an automobile that you have directly as well as make use of for service purposes. Common cars and truck insurance coverage covers lorries for individual usage commuting, running errands, car pool, etc. One more distinction is that business automobile insurance might have higher insurance coverage limitations than an individual plan.

Because of that, commercial car insurance coverage is much more expensive than personal insurance coverage. If you possess the company that guarantees commercial vehicles, you may be able to assert a tax obligation reduction on your industrial car insurance. This will not use if you are listed as a chauffeur on your employer's industrial vehicle plan.