Still, it might likewise bring high unforeseen costs if you happen to enter a mishap, and also as we all know, it is tough to prepare yourself for unforeseen expenses. If you like to remain on a near course as well as avoid any type of unforeseen expenditures, the cost for a 0 deductible policy could be worth it for you.

If you take place to reside in any one of these states, you would certainly have to pay a deductible for accident security and without insurance motorist property damage, no issue what. See to it to speak with your insurance policy firm for even more detailed details. Do you always have to spend for your insurance deductible? Luckily for you, you don't always need to pay a deductible for your insurance company to cover you.

However, if the costs of the problems surpass the limit of the at-fault driver's insurance coverage and you determine to run the continuing to be costs via your insurer, you might still have to pay for the deductible. cheap car insurance. On the other hand, if you're the one responsible for the mishap, while you may not have to pay the insurance deductible to cover the other vehicle driver's expenditures, you will certainly still need to pay an insurance deductible for your insurance provider to cover your own prices.

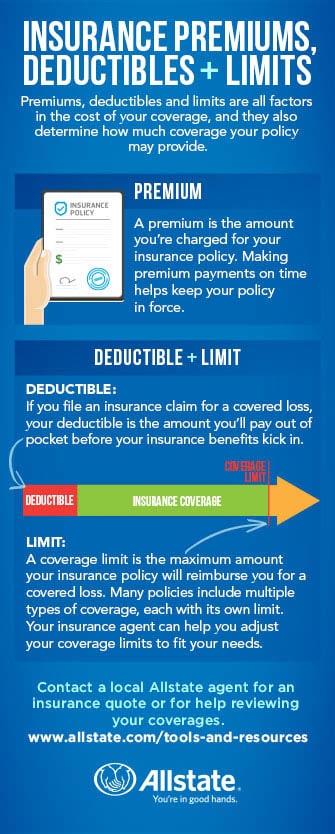

What is the distinction in between an insurance deductible as well as a costs? Unlike a deductible, your costs is typically paid on a month-to-month, annual, or semi-annual basis.

Will boosting my insurance deductible really conserve me money? The short and simple solution to this concern is indeed; if you raise your deductible, you will certainly conserve cash on your premiums.

If your deductible is incredibly high, You will certainly be in charge of paying it in full whenever an insurance claim takes place. Having a high deductible could additionally adversely influence you in the occasion of filing a tiny claim. If the expense of problems you are applying for are much less than the expense of your insurance deductible, it will make no sense for you to even submit the claim.

Our What Is A Deductible? - Njm Diaries

If you have an adequate amount of financial savings to pay a large amount simultaneously, than it may deserve opting for a greater deductible. Otherwise, then you will most likely be far better off with a reduced insurance deductible to guarantee you will not be left in any type of economic bind.

As an example, if you live in a city that has a large volume of tiny crashes as an outcome of hefty website traffic, after that a low insurance deductible is possibly your best option as you might be more probable to enter into a mishap than somebody living in a low booming area - low cost auto.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/HowToChooseYourCarInsuranceDeductibleSept.202021-e95559dfe0df4d0fb74b77b657c0bd52.jpg) insurance cheaper insurance company auto

insurance cheaper insurance company auto

This is so you won't have to pay out such a huge amount each time that you make an insurance claim. However, if you have a spick-and-span driving record, having a higher insurance deductible might be valuable for you. Conclusion: You have options Choosing what rate to set your deductible at can be a hard choice.

Have more inquiries concerning your insurance deductible, superior or various other coverage choices? Contact us with among our qualified insurance specialists today.

Your auto insurance deductible is the amount of cash you 'd add when your insurance policy firm pays for a covered insurance claim (cars). How do vehicle insurance policy deductibles function?

Anytime you're in a car crash and there are problems to your automobile that would certainly be covered under detailed or crash coverages, you'll be accountable for paying the insurance deductible under each of those insurance coverages. If you have numerous vehicles on your car insurance coverage policy, you can likewise choose various deductibles for each auto (auto insurance).

Not known Details About Everything You Need To Know About Your Car Insurance ...

You can select various insurance coverage limitations for all of them, as well as set deductibles, depending on which coverage it is. Why can't you always choose your insurance deductible?

Because they aren't responsible for as much cash, they have much less threat. So they charge a lower auto insurance costs. In brief, a greater deductible equates to reduced insurance coverage costs. A reduced insurance deductible amounts to higher insurance coverage premiums. An example would be an insurance coverage policy with a $500 crash deductible.

auto affordable car insurance cheaper car insurance cheapest auto insurance

auto affordable car insurance cheaper car insurance cheapest auto insurance

When selecting vehicle insurance policy protection, you selected the reduced insurance deductible of $500. What if you picked a high insurance deductible of $2,500? They have much less threat, so you'll pay a reduced premium.

This can be risky service What happens if like in the instance over, you selected a $2,500 insurance deductible but really did not have that money handy? When you submit an insurance claim, you'll be invoiced for your insurance deductible. If you do not have that $2,500 prepared to pay you might be embeded a bind with a fixing shop.

Should you attempt to conserve cash by picking a higher deductible or really feel more safe and secure by going with a lower one? To pick the right insurance deductible for you, you'll require to consider your driving history, your emergency situation fund, and also the expenses of various deductibles, along with a number of various other factors.

Key Takeaways Your insurance deductible is the part of expenses you'll spend for a covered claim. Evaluate your vehicle's value, your reserve, as well as the costs of insurance coverage when picking a deductible. Choosing a greater deductible might assist you save money on costs, yet this implies you'll need to pay even more out of pocket after an accident.

Should I Raise My Auto Insurance Deductible? - Coverage.com Fundamentals Explained

In some states, you may also have an insurance deductible for:: Pays to repair your automobile after damage caused by a motorist without insurance coverage or without adequate coverage.: Pays your clinical costs when you've been harmed in an accident.: Covers the prices of some mechanical repair services, just like a warranty.

Whether you pay a deductible after an event depends upon your insurance coverage, that is at fault, your insurance provider, and your state's legislations. In The golden state, you can qualify for a deductible waiver on your crash protection, which means your insurer will certainly pay the insurance deductible if a without insurance vehicle driver hits you. suvs.

Exactly how Does an Insurance deductible Work? What you'll pay depends on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the price of fixing the damage is the very same or virtually the exact same as your deductible, you may choose not to submit a case considering that you would certainly lose any kind of claim-free discount - vans.

When Do You Pay a Deductible? You'll commonly pay your deductible directly to the automobile repair work store after they complete the fixings.

As the car's worth boils down, the possibility of a total loss goes upmeaning it might not be worth buying optional protections. The Kansas Insurance Department advises carrying just responsibility protection on automobiles worth less than $3,000. Due to a current scarcity of used lorries, Mc, Bride mentioned that you might likewise wish to think about exactly how important your auto is as a method of transport.

Various Discover more Other Inquiries to Ask When Selecting Deductibles While the 3 elements above are one of the most essential when choosing an insurance deductible, you'll desire to ask these inquiries, also. accident. Exists a Required Minimum Deductible? It depends on your insurance company and state. Numerous insurance coverage deductibles start at $250 or $500, yet some insurance firms offer a $0 insurance deductible choice for specific insurance coverages, and also others may require higher-risk vehicle drivers to lug greater deductibles.

Should I Raise My Auto Insurance Deductible? - Coverage.com Can Be Fun For Anyone

What Kinds of Car Insurance Insurance Coverage Need a Deductible? Deductibles are most usual with crash as well as thorough protection. In some states, nonetheless, you may also have a deductible for injury protection or uninsured/underinsured driver home damage coverage.: If you strike another lorry or an item, crash insurance coverage will certainly aid spend for repairs.

Deductibles are typical for this sort of protection and additionally differ by insurer.: Also referred to as PIP, this coverage pays medical bills, funeral service costs, kid treatment expenses, shed wages as well as various other comparable expenses, regardless of that triggered the crash. PIP is not readily available in all states and also where it is readily available, it may be required or optional.

Deductible requirements can also vary by state. What to Consider When Selecting Your Automobile Insurance Deductible, Picking an insurance deductible for your vehicle insurance plan can be a demanding experience.

If you go too high, it might be financially ruining if you have to submit a case. To aid you make the appropriate selection for you, here are some points to think about:: A large reserve may enable you to afford a huge insurance deductible, which might assist you reduce monthly insurance coverage prices - low cost.

: If you have actually financed your vehicle, your lender might need certain types of coverage and also limits on insurance deductible quantities. While you may be able to manage a greater insurance deductible, your lender may not allow it.: If you have actually obtained in several crashes in the recent past, you can be at a greater threat of obtaining in another one, and a lower deductible might be a much better alternative. cars.

There's no one-size-fits-all option for everybody, so it is very important to think about these aspects as well as other facets of your scenario to pick the right insurance deductible for you. Various Other Ways to Save Money On Auto Insurance, Picking the best deductible can provide you a good equilibrium in between conserving on your monthly rate and the quantity you owe when you sue.

Our Car Insurance Deductibles Guide: 5 Key Things To Know In 2022 Diaries

Other methods to conserve on auto insurance consist of: Shopping around and also contrasting quotes from numerous insurance companies, Using price cuts that you certify for, Making adjustments to coverage quantities, Improving your credit history score, Insurer in most states use your credit history record to create what's called a credit-based insurance rating. They after that utilize this rating to aid establish your rate. money.

low cost auto cheapest insurers low cost

low cost auto cheapest insurers low cost

Selecting the best automobile insurance coverage deductible isn't very easy - insurance. A high-deductible vehicle insurance coverage policy brings different economic repercussions than a plan with a low deductible.

cheap insurance cheaper car insurance cheap cheap auto insurance

cheap insurance cheaper car insurance cheap cheap auto insurance

You will certainly have to pay the deductible each time you file a claim. If you have a $3,000 repair work and also a $1,000 vehicle insurance coverage deductible, you would certainly be accountable for paying $1,000.

If the repair costs much less than the insurance deductible, you'll pay the entire bill. Not all types of insurance policy protection have an insurance deductible affixed to them.

And also plans with greater deductibles have reduced costs but greater out-of-pocket costs if you submit a claim. When you file an insurance claim with the insurer, you pay the insurance deductible. The service provider covers expenses that exceed the deductible quantity. Auto insurance coverage deductibles can vary anywhere from a couple of hundred dollars to $2,500.

Regardless of what quantity you choose, it is necessary that you can manage to pay it if you require to sue. When picking a cars and truck insurance coverage deductible, adhere to these 6 actions to discover out which quantity is best for you. There is a relatively simple relationship in between your insurance coverage deductible and also the price you spend for your plan.

The Ultimate Guide To Auto Insurance - Investopedia

cheaper car insurance companies cheaper cheaper auto insurance

cheaper car insurance companies cheaper cheaper auto insurance

You will certainly need to determine how much your vehicle deserves. Compare its value to your insurance plan prices. And keep in mind, you do not need to pick the very same insurance deductible for every kind of protection you have. An insurance representative may have the ability to aid you mix and also match deductible amounts based on your car's worth and the threats you deal with.

If you utilize the typical mileage price, you can not subtract vehicle insurance coverage costs as a separate cost. You can still deduct tolls and also car parking charges. This consists of automobile insurance coverage and also the other products provided above. If you're not sure which one you want to make use of, or which may allow you deduct much more, it may help to examine the gas mileage reduction regulations.