The less experienced the chauffeur, the greater the rates. That's since statistically, inexperienced chauffeurs crash a lot and so they are the riskiest classification of motorists to guarantee. Car insurance rates reflect this high risk. Of course, the large bulk of unskilled drivers are teenagers and those under age 25.

All of this assists insurance companies recognize the danger associated with insuring your car in that ZIP code, whether you ever have made a claim or not. How does my marital status impact my vehicle insurance coverage rate?

But there are likewise other cars and truck insurance coverage discount rates married couples can anticipate when they integrate their policies, such as a multi-car discount rate, or a multi-policy discount rate if they have a tenants or property owners policy with the exact same insurer. An insurance company considers you single if you have actually never been wed, or are widowed or separated. low-cost auto insurance.

Some insurance companies reject anybody with four or more chargeable accidents in 3 years, or more than 3 DUIs in seven years, or more than 15 points on the chauffeur's motor car record. In general, a minor infraction such as a speeding ticket can boost your rates, on average, by 25% to 43%.

5% less, on average, compared to drivers with longer commutes, a Cars and truck, Insurance coverage. How does mileage impact automobile insurance rates? If you drive 12,000 miles a year, or less, your insurance business will typically think about that to be lower than average, and you'll likely pay a lower rate than those who drive more than that.

To get the best low-mileage discount rates, which have to do with 7% on average, you generally need to drive under 7,000 or 5,000 miles yearly. Based on a Los Angeles driver with a complete protection policy, the expense of a policy when the chauffeur logged 20,000 or more miles was 12% more costly than if just 5,000 miles were driven a year.

We asked Charles, the following questions about credit rating and insurance coverage rates: What are the advantages and disadvantages of using a motorist's credit report when setting car insurance rates? Identifying and rewarding chauffeurs with great credit practices can yield consistent revenue and organization stability for insurance providers. A customer's credit report says a lot about them.

The Best Guide To Average Cost Of Car Insurance (With Quotes, Updated April ...

In the long term, insurance provider's development could be limited if some customers are evaluated of the marketplace, this can have a cascading result where lower sales cause decrease revenues and lower ROI. It may be best to take calculated risks and make policies readily available at budget friendly rates to those with lower credit ratings (cheaper car).

Conventional consumers, with excellent credit ratings, are an essential base for a strong insurance coverage organization. These consumers are constant about paying their expenses and insurance companies should reward them with the best rates.

However insurance providers are everything about risk and numbers, and if their research study states that people with bad credit are frequently bad chauffeurs, one could make the argument that charging greater dangers is reasonable. Even if it kind of seems like the insurance company is kicking the individual with bad credit while they're down.

Consumers with low credit history often will not receive regular monthly billing, or they might need to pay a large percentage of the policy up front and the remainder monthly. In any case, fair or not, credit report frequently do have an effect on one's insurance coverage premiums. If you desire them to go down, it makes sense to try to make your credit rating go up.

The more coverage you get, the more you will pay. If you get a bare-bones liability policy that covers just what the state needs, your automobile insurance costs are going to be less than if you bought protection that would fix your own car, too. Liability protection tends to cost more because the quantity the insurance coverage company dangers is greater - cars.

If you do not have enough liability coverage, you could be taken legal action against for the difference by anyone you injure. The greater the deductible, the less the insurance coverage company will have to pay-- and the lower your rates.

Without some kind of medical coverage, if you do not have health insurance coverage in other places, you might not have the ability to spend for treatment if you are hurt in a mishap you caused. One way some chauffeurs can restrict their insurance expenses is with pay-as-you-drive insurance coverage. This type of insurance coverage bases the expense of your premium on how much you drive, and may take into consideration other driving practices also.

Car Insurance Rates By Make And Model 2022 - Finder.com - The Facts

Otherwise, these motorists "pay roughly the same yearly fixed costs for insurance as another motorist with high annual mileage."How much is car insurance coverage per year? Here's how much the average chauffeur, with good credit and a tidy driving record, would pay for the following protection quantities, based on Vehicle, Insurance.

The average rate for 50/100/50 is. The average rate for 100/300/100, with extensive and accident and a $500 deductible is (auto insurance). Bumping state minimum up to 50/100/50 expenses simply $129, so it's just about $11 a month-- Going to 100/300/100 from 50/100/50 expenses, to double your liability protection.

These theoretical chauffeurs have tidy records and great credit. Average rates are for comparative functions. Your own rate will depend on your personal aspects and lorry.-- Michelle Megna contributed to this post.

Insurance service providers desire to see demonstrated accountable habits, which is why traffic accidents and citations are consider identifying car insurance rates. Points on your license don't stay there permanently, however how long they remain on your driving record varies depending on the state you live in and the severity of the offense.

For example, a brand-new sports cars and truck will likely be more expensive than, say, a five-year-old sedan. If you pick a lower deductible, it will lead to a higher insurance expense which makes selecting a higher deductible appear like a pretty excellent offer. A greater deductible might imply paying more out of pocket in the event of an accident - low-cost auto insurance.

What is the typical cars and truck insurance cost? There are a wide array of factors that affect how much automobile insurance coverage expenses, that makes it tough to get a precise idea of what the average individual spends for cars and truck insurance coverage (insured car). According to the American Auto Association (AAA), the typical expense to insure a sedan in 2016 was $1222 a year, or around $102 each month.

Nationwide not just offers competitive rates, however likewise a variety of discounts to assist our members save even more. How do I get vehicle insurance coverage? Getting a car insurance quote from Nationwide has never been much easier. Visit our car insurance coverage quote area and enter your postal code to start the automobile insurance quote process.

The Ultimate Guide To How Much Does Car Insurance Cost On Average? - The Zebra

In almost every state, a minimum of some quantity of cars and truck insurance coverage is required by law to support the wheel. Being legally needed, vehicle insurance is crucial to keep you protected from the financial problem of a range of bad things that can happen in, around, and to your vehicle. insurance company.

We'll break down how we price Lemonade Cars and truck policies, so you can get the realities and make an application for the coverage you need with self-confidence. car. The most uncomplicated way to get a sense of how we price Lemonade cars and truck insurance is by obtaining coverage. It's quickly, easy, and basic to compare.

Picking a greater deductible will usually result in lower premiums, considering that it implies you 'd be responsible for more of the preliminary expenses in the occasion of a mishap. insurance affordable. What the cost of Lemonade Automobile covers If you wish to take a deep dive into all of the protection types used by Lemonade Cars and truck, we've got you covered here.

If you have an interest in finding out more about a policy with Lemonade Vehicle, the simplest method to explore your coverage optionsand what you 'd payis by requesting a quote. It's fast, easy, and even a little fun.

Average Cars And Truck Insurance Rates by Protection Level When it comes to safeguarding your cars and truck, we comprehend that everybody's needs are different. That's why we provide different kinds of automobile insurance protection. Having full coverage helps you stay safe on the roadway. This is also among the factors why the typical cost of cars and truck insurance varies between customers.

For instance, a policy that will spend for home damages up to $50,000 will have a higher premium than one that only spends for repairs approximately $25,000. Typical Car Insurance Coverage Rates by Age Your automobile insurance coverage rates will also vary based upon your age group. car insurance companies frequently consider young chauffeurs, like teens, to be more of a threat behind the wheel.

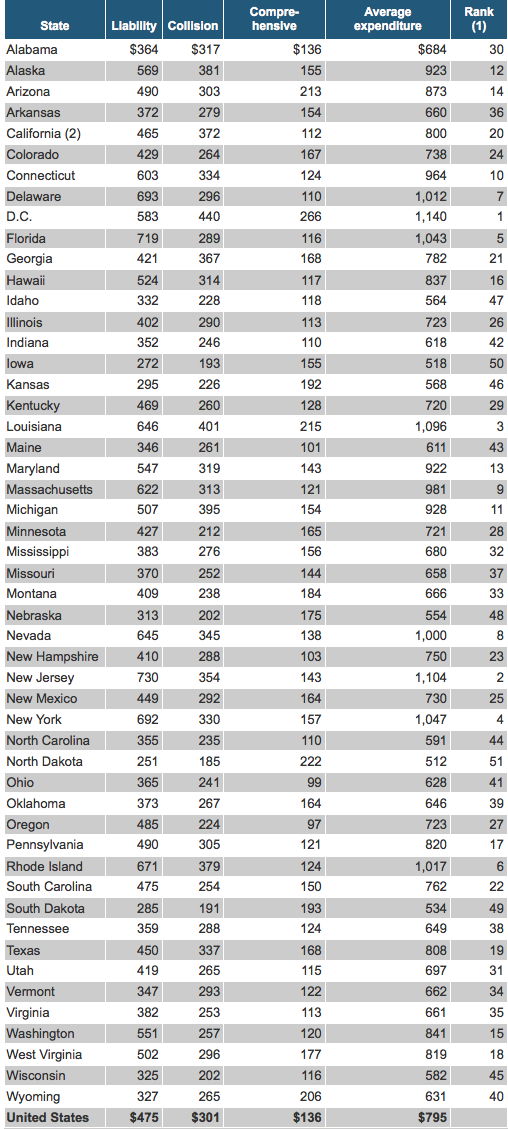

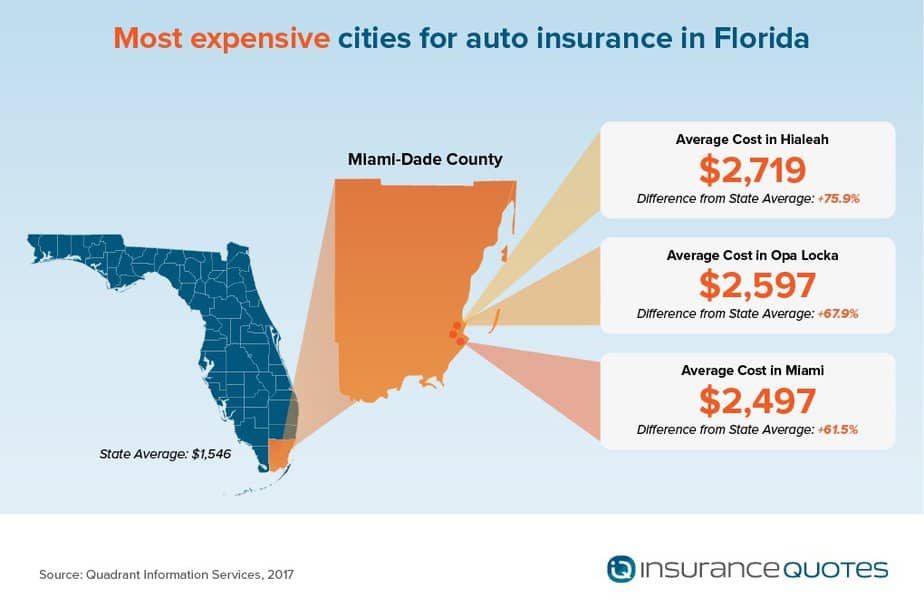

Average Cars And Truck Insurance Coverage Rates by State The average car insurance coverage rate by state varies. According to the Insurance Coverage Info Institute (III), Iowa has some of the least expensive vehicle insurance in the nation at $674, while Louisiana had some of the most costly at $1,443.

The 7-Second Trick For Facts + Statistics: Auto Insurance - Iii

At What Age Is Cars And Truck Insurance Coverage Cheapest? 5 That implies as a motorist gets older and gains more experience on the roadway, their rates will likely reduce.

Which Age Group Pays the A Lot Of for Automobile Insurance? Since 1984, The Hartford has helped nearly 40 million AARP members get the vehicle protection they require through special benefits and discount rates What State Has the Most affordable average car insurance rates? According to III, in 2017, these states had some of the lowest automobile insurance rates:8 To discover more, get a quote from us today.

They'll assist you get the car policies you need, whether it's to help pay for damages after a mishap or to secure you from collisions with uninsured motorists. cheaper cars.

In this article, we'll explore how average automobile insurance coverage rates by age and state can fluctuate. Whenever you go shopping for car insurance, we recommend getting quotes from numerous companies so you can compare protection and rates.

Why do typical car insurance coverage rates by age differ so much? 5 percent of the population in 2017 but represented 8 percent of the total expense of vehicle mishap injuries. cheapest.

The rate information originates from the AAA Foundation for Traffic Security, and it accounts for any mishap that was reported to the cops. The average premium data originates from the Zebra's State of Vehicle Insurance report. The prices are for policies with 50/100/50 liability protection limits and a $500 deductible for thorough and crash coverage.

According to the National Highway Traffic Security Administration, 85-year-old men are 40 percent most likely to get into a mishap than 75-year-old guys. Looking at the table above, you can see that there is a direct correlation between the crash rate for an age group which age's average insurance premium. vehicle.