insurance companies cheaper car automobile vehicle insurance

insurance companies cheaper car automobile vehicle insurance

Actually, vehicle drivers of leased or funded autos are commonly required to get this insurance policy in order to shield the car proprietor or loan provider's investment. Although different from accident insurance, a motorist needs to usually have crash insurance policy in order to be able to acquire extensive coverage [ resources: Allstate, Maine Bureau of Insurance]

A higher insurance deductible means that the motorist will certainly have to cover more of any damages prior to the insurance coverage kicks in, yet likewise decreases the total costs. Boosting the deductible from $200 to $500, for circumstances, can decrease costs by 15 to 30 percent [source: Kiplinger] Naturally, a person who chooses a greater insurance deductible will certainly want to make sure that he or she can pay it on the occasion that the cars and truck is damaged and must consider upfront costs cost savings versus a greater deductible on the back end.

When determining on the appropriate car insurance policy for your household's demands and also your budget, remember that you require to comply with your state's legislations when it involves minimum protection (insure). All states call for vehicle drivers to have some form of financial responsibility in area in order to sign up a lorry and drive it in the state. cheaper auto insurance.

On top of those minimums, auto insurer offer various other kinds of automobile insurance that can supply greater defense if someone gets injured in a vehicle crash, or a vehicle becomes broken (in a mishap or otherwise). With this extra security comes added cost, via a greater costs. low cost auto. And depending upon the driver and the automobile, the additional insurance coverage may not constantly deserve the additional money.

car insurance car insurance insurance company insurance affordable

car insurance car insurance insurance company insurance affordable

cheaper auto insurance low cost auto car business insurance

cheaper auto insurance low cost auto car business insurance

This protection will apply if your crash involves an additional automobile, you struck a stationary things, or your car surrender (cheaper cars). However, accident protection does not generally cover car damages that is the outcome of a collision with a pet. Comprehensive coverage exists to cover damage to your car that happens when no person is driving it, such as when it's parked in your driveway or in a vehicle parking great deal.

Get This Report on The Instant Insurance Guide: - Delaware Department Of ...

Furthermore, detailed coverage will certainly pay for fixings resulting from a crash entailing a pet. It may be the regulation to have vehicle insurance coverage or some various other kind of financial duty, however lots of motorists go without coverage. business insurance. And also even a lot more vehicle drivers only acquire the state's minimum insurance coverage, which is often inadequate to totally compensate https://tiny.one you after a serious crash.

Medical settlements protection, often referred to as Med, Pay, is really similar to PIP because it covers medical costs for you, other licensed chauffeurs, and any type of guests. money. Nevertheless, Med, Pay differs from PIP in that it normally doesn't cover as lots of expenditures. Depending on the state, PIP may cover a certain cost (such as funeral costs or shed salaries) that Med, Pay does not, or the other way around.

In this situation, you must pay the distinction to the dealer or lender. Space coverage protects you in these scenarios by paying for this distinction or "gap. insurance company." The answer to this question will depend upon lots of variables, such as your aversion to run the risk of, exactly how much insurance you can afford, the cost of your car, what state you're in as well as what various other insurance protection you may have.

prices insurance affordable affordable car insurance perks

prices insurance affordable affordable car insurance perks

Here, we'll give you a breakdown of various vehicle insurance kinds, terms, and what they all suggest. What are the major different kinds of vehicle insurance coverage?, there are 6 key types of vehicle insurance coverage, each offering a different set of coverage.

Claim somebody is driving a good friend's car, strikes a patch of black ice, as well as slides right into a ditch. cheaper cars. That chauffeur's insurance policy coverage will certainly pay to fix or replace the car they were driving, minus any appropriate deductible (car insurance). Here are several of the reasons to consider extensive insurance coverage: The driver stays in a location with a high price of vehicle burglary, The driver resides in an area vulnerable to all-natural calamities (like typhoons, quakes, blizzards, volcanos, and also twisters) The vehicle driver's automobile is useful as well as they don't have money to pay for fixings (or substitute) if they remain in a mishap that is not covered.

The Best Guide To Comprehensive Insurance Coverage - Wex - Us Law

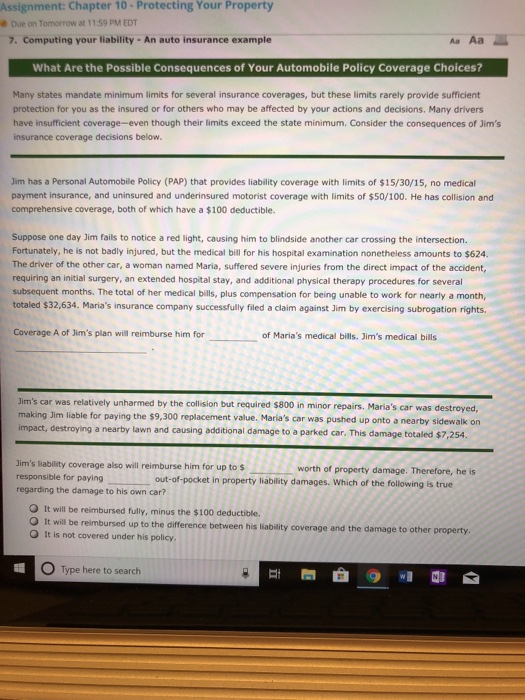

If the vehicle driver has a deductible of $1,000, collision insurance coverage will pay $3,000 - risks. 3. Liability, Most states call for motorists to bring responsibility insurance (low-cost auto insurance). The minimum obligation insurance coverage required differs by state regulation. There are two sorts of responsibility insurance: If someone remains in an accident and also located legitimately accountable for injuries to one more individual, physical injury obligation insurance policy spends for medical bills, shed wages, and pain and also suffering.

Residential property damage obligation insurance coverage will certainly pay to fix the vehicle the chauffeur hit as well as deal with the harmed tree. Without insurance vehicle driver and underinsured motorist, Some states need uninsured vehicle driver protection as well as underinsured vehicle driver insurance coverage while others do not.

If a motorist creates the mishap without appropriate insurance coverage, underinsured driver protection will certainly complete the coverage spaces (dui). 5. Clinical settlements, Like most of these policy types, medical settlement coverage is optional in some states as well as needed in others. This covers the policyholder, member of the family driving the insured vehicle, as well as any type of passengers.

6. Injury, Personal injury security (PIP) is not readily available in every state (risks). It resembles medical repayments insurance coverage because it covers clinical costs following an accident. Accident security insurance coverage goes one action additionally by supplying additionals like loss of earnings, residence cleaning solutions, and child care costs while the vehicle driver is recuperating.